How to invoice for your work

You would think that everyone knows how to get paid for their work. But I’ve been on the receiving end of hundreds of invoices, and it’s now clear that the practice remains a mystery for many. So here are a few tips on how to create, send, and tack an invoice until it becomes a check!

What is an invoice?

An invoice serves 2 purposes:

- It’s the detail of what you are charging for goods or services

- It’s a receipt for the company paying it, used to prove that they aren’t just laundering money (although the actual proof would be the “paid” invoice, and not the original invoice)

The bare minimum needed for a document to become an invoice is:

- The name and physical address of the entity who is billing (you!)

- The description of goods or services being billed

- The amount to be paid

- The entity (vendor) you are billing

If you ever send someone an invoice with these 3 items only, chances are they will ask you to add more information. That’s because although it is enough detail to be paid, it leaves a lot of room for confusion down the road.

So, ideally, you should also include:

- Your contact information (phone and email)

- An invoice number

- The date of the invoice

- The project(s) you are invoicing for

- The payment terms

How to make the perfect Invoice

Let’s go into details for each of the elements of an invoice:

The name and physical address of the entity who is billing: This usually means yourself. In most cases, it’s as simple as your first and last name, followed by your mailing address. Sometimes, it can be a company name if you have one, and can also include the name of someone who is receiving checks for you. Here are a few possibilities:

- Quentin Frismand

- Evil Corp f/s/o Quentin Frismand (“f/s/o” means “for the services of)

- Quentin Frismand c/o Amazing Talent Agency (“c/o” means “care of”)

- Evil Corp f/s/o Quentin Frismand c/o Amazing Talent Agency

Unless specifically mentioned somewhere else on the invoice, this name will be the name written on the check issued. So make sure that you are able to cash a check made out to that name.

It’s also important to note at this point that an invoice is one piece of what I’ll call the “holy trinity” of a vendor’s paperwork:

- Invoice

- Contract

- W9 form

The name on these 3 documents should be the same. Meaning that if the contract you signed is made out to “Quentin Frismand”, the invoice and W9 form should also read “Quentin Frismand”. If the names on these documents don’t all match, the accounting department you are dealing with will be in their right to refuse to process the payment.

Most of the time, the physical address on the invoice will be used to mail the check. Ideally, the address on all 3 documents mentioned above should also match. But, there are instances where the check is not mailed to the company billing, but to a talent agency for instance. In these cases, it is definitely a good practice to specify very clearly where the check should be mailed (and it’s worth noting that it usually requires a document called a “Check authorization” as well. More about talent payments in a future post).

Your contact information (phone and email): This is used by the accounting department processing your invoice to ask you questions if they have any. Very often, if there is no contact information, and something is missing to process the invoice (or if, for instance, the clerk is not sure which address to send the check to), the invoice will be put aside to a pile that might stay on hold for a couple days, until the accounting clerk checks in with someone else within the company that could obtain the missing information. And just like that, several days can go by. Always assume that the person processing your payment has too much work, because it’s almost always the case.

An invoice number: This is very important for everyone’s sanity. Like everything else in this world, having a number to refer to an object is always helpful. For example: if you buy call a store about an item they have listed online, it’s always faster to give them the SKU rather than the name. That’s why they display it online. A number is a unique entry in a database. It makes referring to things easy.

An invoice number is a way for you to track a specific payment, and a way for the accounting department to access its the details. If you work for the same company on a regular basis, you will at some point ask about the status of a specific invoice. That invoice number will come super handy then!

If no invoice number is present, one is usually made up by the accounting clerk using the date on the invoice. But that leaves room to miscommunication. Most people use a sequential invoice number system. Meaning that for each invoice they create, they go up a number (1, 2, 3…). When paired with the name of your entity, it’s usually enough to find 90% of invoices within seconds.

But, you can use a much better system than this. For instance, adding your initials to the number can make your invoice number more unique, thus removing the need to even mention your entity. For instance: “QF1” would be my first invoice.

You can also incorporate other information into the invoice number. For instance, the date: “QF090517”. This makes it simple to visualize when money will be due if you list all your invoices numbers and amounts in a spreadsheet.

You can combine all of this into your own system that works for your needs. For instance, you could combine your initials, date, sequential number and an additional number/letter to indicate that the invoice is part of a series (let’s say if you are invoicing at the beginning, middle and end of a project): “QF090517-1-A”

This isn’t easy to come up with at first, and you don’t need to overcomplicate the process if you only invoice one employer every couple of weeks. As long as it lets you track all your payments and gives you the ability to reference an invoice quickly with an employer, you’re golden!

The date of the invoice: Most companies on the surface on the earth use what we call a “net 30” payment schedule. Simply put, they have 30 days to pay you (including weekends and holidays), usually starting from the date at which all necessary documents were received. Most often, the invoice being the last piece of paperwork drafted, the 30 days start when you turn it in.

This is why it’s important to have a date on your invoice. It lets everyone (you and your employer) know when the invoice was submitted, and thus, when the invoice is due.

You can even add a “due date” to your invoice, but make sure that it matches the payment terms on your contract (it will say in your deal memo wether it’s net 30 or something else).

Finally, note that unless your contract outlines what the fee for a late payment is, nothing that you put on your invoice is enforceable. And in order for you to collect a late fee, you would have to go to court.

The entity (vendor) you are billing: That’s the name of the company you are working for. That’s usually the name of the company on your contract. It is important to have something here, as an invoice made to no one can’t be used as a proof of transaction.

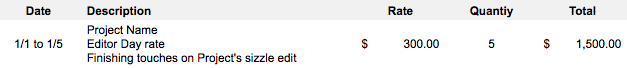

The description of goods and services being billed, The project(s) you are invoicing for & The amount to be paid: You might have spent the last 10 years of your life working on a specific project, but the people collecting and processing your invoice work across a multitude or projects. For them to be able to “code” your invoice (ie. attribute the dollar amount to a specific line item in a budget), they need to tell them what you did.

Be as specific as possible. You should write down things like:

- The dates your worked

- The project(s) you worked on. Employers usually prefer each project to be outlined separately, or even invoiced separately. Ask what they prefer, and ask the name of the project (it’s not always what you think it is)

- Your position/Title

- The type of work you performed (Trailer edit, Finishing touches to an edit, Grip & Electric prep day etc…)

- How the fee is broken down: flat, weekly, daily, or hourly rate

- The fee’s base price

- The quantity of work (1 script, 1 day, 3 hours etc…)

In the end, your invoice’s description should look something along these lines:

Again, the main idea here is to leave no doubts regarding the nature of the payment. The less questions people ask, the faster the invoice gets processed.

The payment terms: By this, we refer to 2 things: the way the payment will be issued, and the speed at which it needs to be processed. If you would rather be paid via bank wire (commonly referred to as “ACH”, for “Automated Clearing House”), this is were you should mention it. Most accounting department have a dedicated form to collect banking information (ask for it when you sign your contract or fill/send a W9 form), but a reminder on the invoice that the payment should not be cut as a physical check is always good. You can write something like:

“Payable to Quentin Frismand via Direct Deposit

Net 30, Due on 01/30/17″

That’s all you need to remind everyone that you should not be cut a check and that you’ll be knocking on their door on January 30th if you haven’t received the payment.

How to send your invoice

Making a great invoice is only the starting point. I have witnessed many invoices disappear in limbo because they had been sent to the wrong person, or because they were sent too early.

Every project has a “project manager”. They’ll have different titles, but the same responsibilities. You need to find out who is in charge of the budget on the project you are working on. If your only contact is someone with creative duties only, you are in trouble. You need to figure out who should be CC’ed in addition to that contact.

Do not send invoices directly to an accounting department. In the best case scenario, that invoice will land in a pile, which, after a few days, will be sent to a possible project manager in the company. But in most cases, that invoice is lost.

Do not send an invoice without a W9 form, unless you have provided it when you signed your contract. If you haven’t signed a contract, ask to do this first. Simply put, people lose things. If you send an invoice today, and the rest of the needed paperwork a week later, there’s a 50/50 chance that the invoice hasn’t been set aside, and unless you re-send it or remind your contact of that invoice, it’s likely that your invoice is lost.

When you send an invoice, create a dedicated email for it. The subject line should have your name and the invoice’s number. The body can contain additional information such as the project name and the dates your worked. This ensures that your invoice can be easily found when searching through an inbox (yours and your employer’s).

Ask for a confirmation that the invoice and all the other documents required to pay you have been received. This is the best way to protect yourself down the road.

How to track your invoice

This is the tedious part. Matching check stubs with your invoices can be tricky, but hopefully, your invoice numbering system will make this an easy task.

First, you need an invoice log. This spreadsheet will keep track of your invoices’ details, such as:

- The invoice number

- The description

- The amount

- The due date

Additionally, I would suggest keeping track of the project manager, or the person who acknowledged reception of your invoice. Your log should look a little like this:![]()

The last column will be used to mark what has been received. You can also use some conditional formatting to highlight payments that are closed to being overdue.

Note: If you haven’t read my previous post about “automated document creation“, I would suggest that you take that approach to save you some time. You could for instance find a way to generate a line of data based on what you typed in your invoice, and copy/past that into your tracking log, saving you a little bit of time at every payment.

Thumbnail designed by upklyak / freepik

2 Comments

Dale Ottley · September 14, 2017 at 1:15 am

This was fabulously detailed! Now I’m looking forward to reading your take on an employee vs. and IC

Ruth · August 22, 2018 at 10:55 pm

Thanks, it’s very informative